SME Financing Guaranteed Scheme

100 Per cent Guaranteed Preferential loans

The 100% Guaranteed Preferential Loan details

As a small and medium enterprise owner, the utmost necessity is the capital support in case he/she has a new venture or investment idea.

In the face of economic downturn, SMEs often face cash flow problems.

In view of this, the Government has launched the SME Financing Guaranteed Scheme (SFGS) to relieve the business pressure of SMEs. It has successively launched the “80%” (80% credit guaranteed product SFGS 80), “90%” (90% credit guaranteed product SFGS 90) and “100%” (100% preferential loan SFGS 100) guaranteed products. The Financial Secretary has further extended the application period to December 31, 2001 by announcing the introduction of the optimization measures in the year of 2021-22 Budget. Under the optimization measures, the application threshold is lowered and the loan amount is increased significantly.

An eligible enterprise should have been in operation for at least three months prior to June 30, 2020, and its turnover in any single month since February last year has decreased by 30% or more compared with the average monthly turnover in any quarter prior to the beginning of 1999 to the period of 2020. The maximum loan for each company has been raised to the sum of 18 months salary and the total rent expenses, or HK $6 million. The lower shall prevail. At the same time, the maximum repayment period for the preferential loans has been increased to eight years and the maximum repayment period for non-interest repayment arrangements has been increased to 18 months.

100% Guaranteed Preferential Loan Scheme

How much capital can be provided for me?

The maximum amount applied for the 100 per cent guaranteed preferential loan is HK $6 million, or the sum of the monthly salary of the company employees plus the monthly rent multiplied by 18, whichever is the lowest.

Case no.1:

Company X is a small and medium-sized enterprise with 15 employees and an average monthly salary of HK $20,000. The monthly rent is HK $30,000. When Company A successfully applies for SFGS100, the amount it will receive is

20,000*15*18+ 30,000*18= $5,940,000, less than the $6 million limit, so you will be eligible for full loan.

Case no. 2:

Company Y is also a SME with 20 employees and an average monthly salary of HK $20,000. The monthly rent is HK $30,000. When Company B successfully applies for SFGS100, the amount it can obtain is

20,000*20*18+ 30,000*18= $7,740,000, exceeding the limit of 6 million, the loan amount is 6 million.

| What enterprises are eligible to apply for

|

Is it difficult to apply for “100% Guaranteed Preferential Loan”?

The key statistics of 100 % guaranteed preferential loans compiled by the Hong Kong CICC Corporation show that 28,000 cases of 100 % guaranteed preferential loans have been granted by CICC insurance company at a total of HK $45 billion!

This loan application is subject to the approval of the bank. There is a huge demand at present. It will take some time to consolidate the documents and wait for approval.

The banks have also rejected many applications with incomplete documents, causing the bosses to worry about the difficulty of getting applications. In the recent economic downturn, the banks have set higher requirements for loan approval than before. Many SME bosses may be wondering whether they can really apply for a bank loan successfully.

In fact, when many SMEs in Hong Kong apply for “100 per cent guaranteed preferential loans”, they are likely to encounter various difficulties even if they meet the application criteria, such as:

- .Not good at paperwork.

- .Fear of application failure.

- .Fear of the troubles.

- .Fear of one’s own company’s credit record and so on.

No interpersonal relations, unaware of financing knowledge and paper processing,

or no idea of how to apply for 100 % guaranteed preferential loan?

Please rest assured, we have been in cooperation with the major banks, and have successfully assisted hundreds of SME owners to apply in just a few months. Make an appointment with our financing consultants immediately to help you solve your business troubles immediately! And be a part of the successful application!

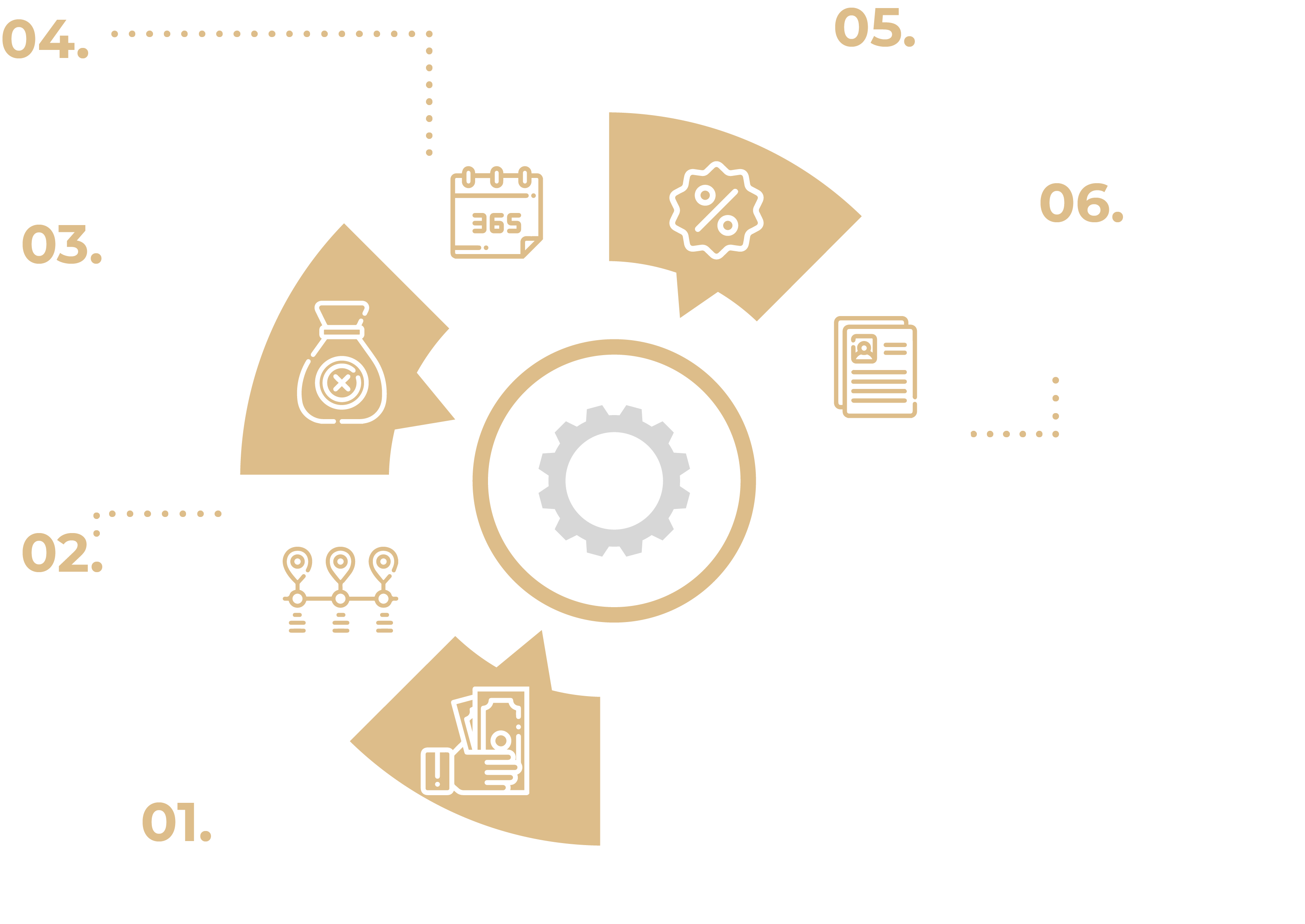

Our Services

![]()

![]()

![]()

We will arrange dedicated specialists to assist in the preparation of required documents such as business registration, operation certificates, business data and so on, and can quickly match customers with the right banks to improve the successful rate of the application, to speed up the whole application process, and to complete the application smoothly.